Linqqs ERC

Linqqs ERC - Specialists In Employee Retention Tax Credit

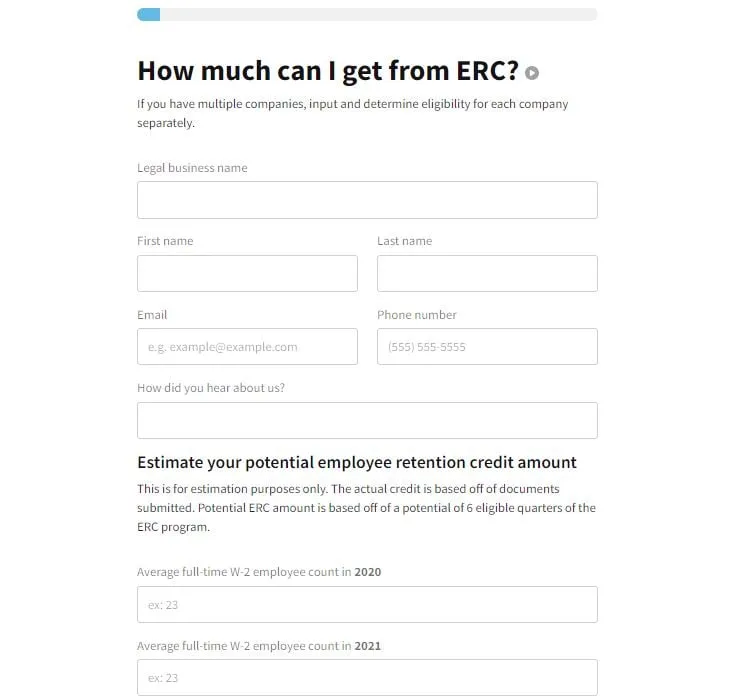

With the introduction of programs like the Employee Retention Credit (ERC), businesses have an opportunity to leverage strategic financial initiatives for internal growth. This comprehensive guide discusses Linqqs ERC, a leading specialist in this field.

What is Linqqs ERC and how is it related

to Employee Retention Credit?

Defining ERC and Its Importance

The ERC is a legitimate tax refund initiative established by the Internal Revenue Service (IRS) to support employers retaining their employees during financial hardships. It's a form of tax credit that enables businesses to offset costs associated with employee retention, thereby fostering continuous operation and economic growth. Notably, the eligibility and computation of the credit are factors that require careful consideration.

The Role of Linqqs in ERC

Linqqs ERC is a specialist firm expertly providing service in navigating the complex terrain of the ERC program. The company helps employers and small business owners access this program, determine their qualification, and appropriately claim their ERC refund. With Linqqs, businesses get to maximize this opportunity and, in turn, realize meaningful financial benefits.

Understanding the Connection Between ERC and Employee Retention

A strong correlation exists between ERC and employee retention. Essentially, the ERC program acts as a financial buffer. It helps businesses sustain their workforce by qualifying for a tax credit, which directly influences employee retention strategies.

Is Linqqs a reliable service provider when it comes to ERC?

Evaluating The Legitimacy of Linqqs: Is It A Scam Or Not?

Professional industry observers have warned employers to be prudent in choosing providers for the ERC program. By maintaining a transparent office operation, showcasing client transcripts, and having the likes of Mark Campbell feature in YouTube and Business RadioX interviews, Linqqs showcases its legitimacy reassuring clients that it's not a scam.

Linqqs’ Partnership with IRS – A Strategic Solution

Linqqs partnership with the IRS has been a strategic solution to ensure businesses receive accurate guidance and service concerning the ERC program. Their collaboration ensures conformity to set guidelines and keeps businesses well within the legal boundaries of the program.

Client Transcripts and Kommentare: Verifying Linqqs' Reputation

Client transcripts and Kommentare available in different public forums like North Fulton Business Radio reveal Linqqs' impressive reputation. Clients across the network verify the excellent support the firm has provided in helping them reap optimum benefits from the ERC program.

How can Linqqs ERC help employers and small businesses with the employee retention tax credit program?

Navigating The Claim Process with Linqqs

Linqqs ERC simplifies the claim process for employers by providing expert guidance on eligibility factors, financial computations, and other paperwork needed. The firm further liaises with the IRS on behalf of the company, making the process even smoother.

How Linqqs Helps Maximize Your ERC Opportunity

Linqqs ERC employs an overarching approach that extends beyond the claim process. It partners with businesses to implement strategies that enhance employee retention and maximizes the tax credit opportunity, providing overall financial stability.

Connect with Linqqs: Start Your ERC Journey

Linqqs makes it relatively easy for employers to commence their ERC journey. In 2022, through their office or digital channels, businesses can connect with the firm and initiate their application. This process positions businesses strategically for optimal financial gain.

What are the financial services offered by Linqqs in relation to ERC?

Understanding Linqqs' Suite of Financial Services

Linqqs offers comprehensive financial services aimed at assisting businesses leverage the ERC program. This includes performing payroll tax audits, financial advice related to the ERC program, and liaising with the IRS on the business's behalf. This suite of services ensures that all financial aspects of a business's ERC application and management are aptly covered.

How Hiring a Linqqs Specialist Can Benefit Your Business Financially

Engaging a Linqqs specialist brings a wealth of expertise and a focus on compliance that injects surety into the otherwise complex ERC application process. The tailored approach pays attention to individual business needs and the potential benefits resulting from the intricacies associated with the tax credit program.

Meeting the Linqqs Team: An Introduction

The Linqqs team consists of financial experts, CPA's, and tax specialists who have embarked on hundreds of successful ERC applications. The collective knowledge of this team drives excellent results for clients across various industries.

How can businesses leverage Linqqs ERC for effective employee retention?

Using ERC to Retain & Motivate Employees

With the guidance of Linqqs ERC, businesses can use the program to not only retain but also motivate their employees. The savings gained from the tax credit can be repurposed into resources that improve the employees' overall work experience.

The Direct Impact of ERC on Small Business Owners

For small business owners, the ERC's direct impact can be substantial. The tax credit can provide the critical financial reprieve needed to maintain or even expand their workforce during challenging times. Linqqs ERC’s skill in capturing this opportunity for businesses cannot be overemphasized.

Don’t Miss Out: Ensuring Eligibility with Linqqs

Ensuring eligibility for the employee retention tax credit is a crucial factor in leveraging the benefits of the ERC. Linqqs works closely with businesses to ensure that all the specific considerations for eligibility are met and optimally utilized.

But Hold On

What's next beyond the ERC?

Linqqs Beyond the Credit!

Business insurance in a dash: Why do you need business insurance?

Cost Segregation Made Easy: What is Cost Segregation?

R&D Tax credits: What is the Federal R&D Tax Credit Program?

Health and Wellness can be free: What is LHMP?

Helping the self-employed: What is the Families First Coronavirus Response Act and American Rescue Plan?

Frequently Asked Questions

Can you provide a general description of what Linqqs ERC is?

Yes, Linqqs ERC specializes in helping companies take advantage of the Employee Retention Tax Credit, a generous incentive offered by the U.S Government under the CARES Act. This credit is designed to help businesses that were significantly impacted by the pandemic. It's available to businesses as well as non-profits and even churches.

I have seen some comments suggesting that Linqqs ERC might be a scam. Are these true?

No, the allegations labeling Linqqs ERC as a scammer entity are not true. Linqqs ERC is a trusted advisor in the domain of Employee Retention Tax Credit, aiming to assist eligible businesses to collect the benefits they are entitled to according to the CARES Act. Always ensure to verify the identity of any financial service you work with, Linqqs ERC is always transparent and honest in its operations.

Can I have a transcript or report of my transactions with Linqqs ERC?

Absolutely! Linqqs ERC believes in transparency and trust, so at any time, we can provide you with a transkript or statement indicating the status of your Employee Retention Tax Credit process.

Can Linqqs ERC partner with my bank for efficient transactions?

Yes, Linqqs ERC can collaborate with your bank to ensure efficient handling of your Employee Retention Tax Credit. However, loan facilitation isn't within their scope of services.

Does LINQQS ERC only work with for-profit companies?

No, LINQQS ERC is dedicated to helping all businesses including non-profits and even churches. They aim to maximize the available benefits for all organizations that were greatly affected by the pandemic and may not otherwise qualify for aid.

What happens if my church or other non-profit is deemed ineligible?

If your church or non-profit falls under the ineligible category after a thorough assessment by Linqqs ERC and the IRS, you might not be able to take advantage of the Employee Retention Tax Credit. However, Linqqs ERC works diligently to explore all the possible avenues your organization might be able to benefit from.

What are the solutions Linqqs ERC offers to increase a company's income during the pandemic?

The main solution provided by Linqqs ERC to enhance a company’s income revolves around the Employee Retention Tax Credit. This engaging strategy allows companies to take advantage of maximum credits available to them, thus avoiding layoffs and continuing their operation.

Do I receive anything for referring customers to Linqqs ERC?

Yes, Linqqs ERC has a generous referral program where you can receive a commission for every new customer you recommend. It's their way of banking on marketing from satisfied customers to propagate their trusted services.

What is the connection between Linqqs ERC and my company’s CPA or accountant?

Linqqs ERC can connect and work closely with your company’s CPA or accountant to identify your eligibility for the Employee Retention Tax Credit. Your CPA remains an integral part of your financial decision-making process.

How can Linqqs ERC help my company if we experienced a decrease in sales due to the pandemic?

If your company experienced a significant decline in sales as a result of the pandemic, you may be eligible for the Employee Retention Tax Credit. Linqqs ERC helps in assessing your eligibility and facilitates the process to obtain these benefits.

Conclusion

In these uncertain economic times, the Employee Retention Credit (ERC) emerges as a beacon of financial respite for businesses, particularly small business owners. This tax credit program, aimed at aiding employers in retaining their workforce, holds a substantial influence on economic growth. But navigating the complexities of the program could be daunting. That's where Linqqs ERC steps in - a specialist firm dedicated to helping businesses access and maximize the opportunities offered by the ERC program.

Linqqs ERC's legitimacy, reinforced through transparency in operation, a strategic partnership with the IRS, and widespread client approval, fortifies its position as a reliable service provider. Their comprehensive suite of financial services, ranging from payroll tax audits to financial advice, ensures that businesses remain compliant while optimizing the benefits of the ERC.

The Linqqs team, a blend of financial experts, CPA's, and tax specialists, use their collective knowledge to deliver excellent results for their clients. The firm's unique approach goes beyond just processing claims, offering strategic advice to motivate and retain employees, leading to overall financial stability.

By securing the ERC, businesses can significantly contribute to their financial stability. The credit alleviates payroll expenses, improves operational cash flow, and helps companies weather the economic challenges posed by the pandemic. Employers should also explore refund opportunities and guarantees offered by ERC providers, verifying their accuracy and uncovering any potential hidden costs.

As we've seen, leveraging the ERC program effectively is instrumental for businesses to weather financial adversities and ensure a robust workforce. With Linqqs ERC, businesses are well-positioned to seize this strategic financial initiative fully, strengthening their operation and fostering growth. Engage with Linqqs today to commence your ERC journey and unlock the full potential of this tax credit opportunity.

© 2024 Linqqserc.org. All Rights Reserved.